Introduction

The dissolution of a marriage in Jaipur, a city renowned for its rich cultural heritage and vibrant community, often brings significant financial challenges, particularly for the dependent spouse and children. Indian law provides a robust framework for “maintenance,” a legal provision designed to offer financial support to spouses, children, or parents post-separation or divorce, ensuring they can live with dignity. In Jaipur, where family ties and social structures are deeply valued, understanding maintenance and alimony laws is critical for navigating the complexities of marital breakdown.

The terms “maintenance” and “alimony” are often used interchangeably but carry nuanced differences. These laws, rooted in a blend of secular statutes and personal laws specific to religious communities, are particularly relevant in Jaipur, where diverse communities—Hindu, Muslim, Christian, and others—coexist. This comprehensive guide explores the legal frameworks, eligibility criteria, factors influencing maintenance amounts, and the procedural aspects of claiming maintenance in Jaipur’s Family Courts. Whether you’re seeking financial support or obligated to provide it, clarity on these provisions is essential for informed decision-making in the Pink City.

Table of Contents

Understanding Maintenance and Alimony

The terms “maintenance” and “alimony” are frequently used in family law but have subtle distinctions in their application, though they serve the common purpose of providing financial support.

- What is Maintenance? Maintenance is a broader concept that refers to the financial support provided to a dependent spouse, minor child, or in some cases, even dependent parents, to enable them to live with dignity. It can be claimed while the marriage is still subsisting (interim maintenance), during legal proceedings, or after a final decree of divorce or judicial separation. Maintenance provisions are primarily designed to prevent vagrancy and ensure that financially vulnerable individuals do not suffer due to marital breakdown.

- What is Alimony? Alimony, often understood as a specific type of maintenance, generally refers to the financial support paid by one spouse to the other after the legal dissolution of a marriage (divorce). It can be a lump sum payment or periodic (monthly/quarterly) payments. The term “alimony” is more commonly associated with Western legal systems but is often used in common parlance in India to mean post-divorce spousal support.

- Distinction and Overlap: In Indian legal statutes, the term “maintenance” is predominantly used and encompasses both interim support during a marriage and post-divorce support. For instance, the Hindu Marriage Act, 1955, uses “maintenance pendente lite” (interim maintenance) and “permanent alimony” (post-divorce maintenance). So, while “alimony” specifically implies post-divorce financial support between spouses, “maintenance” is a broader term that includes alimony, as well as support for children and parents.

Legal Framework Governing Maintenance in India

Maintenance laws in India are multifaceted, derived from the secular Code of Criminal Procedure and various personal laws that apply based on the religious affiliation of the parties.

Section 125 of the Code of Criminal Procedure, 1973 (CrPC)

This is a secular provision applicable to all individuals in India, regardless of their religion. It is a social welfare legislation intended to prevent destitution and ensure that wives, minor children (legitimate or illegitimate), and dependent parents are not left helpless. It provides a speedy remedy for maintenance. A wife who cannot maintain herself, dependent legitimate or illegitimate minor children (whether married or not), and dependent parents can claim maintenance under this section. The maximum amount is not capped and is decided by the court based on the payer’s ability to pay. You can find the Code of Criminal Procedure, 1973, on the India Code website: Section 125 CrPC.

The Hindu Marriage Act, 1955 (HMA)

Applicable to Hindus (including Buddhists, Jains, and Sikhs), this Act contains provisions for maintenance during divorce or judicial separation proceedings, and after the passing of a decree.

- Section 24 (Maintenance pendente lite and expenses of proceedings): Allows either the wife or the husband to claim interim maintenance and litigation expenses during the pendency of any matrimonial proceeding (e.g., divorce, judicial separation) if they have no independent sufficient income.

- Section 25 (Permanent alimony and maintenance): Enables the court to order permanent alimony or maintenance to either the wife or the husband, to be paid periodically or as a lump sum, upon the passing of a divorce or judicial separation decree. The quantum is determined based on factors like income, property, conduct, and other circumstances. You can view the full Hindu Marriage Act, 1955 for detailed provisions.

The Hindu Adoptions and Maintenance Act, 1956 (HAMA)

This Act specifically deals with the obligation to maintain various dependents, including wives, children, and parents, even without a matrimonial dispute.

- Section 18: A Hindu wife is entitled to be maintained by her husband during her lifetime. She can claim separate residence and maintenance if the husband is guilty of certain acts (e.g., desertion, cruelty, leprosy, another living wife).

- Section 20: A Hindu father or mother is bound to maintain their legitimate or illegitimate minor children, and also their aged or infirm parents who are unable to maintain themselves. The Hindu Adoptions and Maintenance Act, 1956 is available on India Code.

The Special Marriage Act, 1954

This Act governs civil marriages and inter-religious marriages.

- Section 36 (Alimony pendente lite): Similar to HMA, this section allows either spouse to claim interim maintenance during any proceeding under the Act.

- Section 37 (Permanent alimony and maintenance): Provides for permanent alimony upon the passing of a decree under the Act, payable periodically or as a lump sum. The Special Marriage Act, 1954 can be accessed on India Code.

The Indian Divorce Act, 1869 (for Christians)

This Act governs divorce among Christians.

- Section 36: Provides for interim alimony.

- Section 37: Allows the High Court to order permanent alimony upon the passing of a divorce decree. The court considers the husband’s income, the wife’s fortune (if any), and the conduct of the parties.

Muslim Women (Protection of Rights on Divorce) Act, 1986 (MWPRDA)

This Act was enacted after the Shah Bano case verdict. It stipulates that a divorced Muslim woman is entitled to maintenance from her former husband during the iddat period (a waiting period after divorce). Beyond this period, her relatives (parents, children, etc.) or the Waqf Board may be responsible for her maintenance if she is unable to maintain herself. However, the Supreme Court’s judgments (e.g., Daniel Latifi case) have interpreted this Act to ensure that a divorced Muslim woman can claim “reasonable and fair provision and maintenance” for her lifetime from her former husband, extending beyond the iddat period. Therefore, Section 125 CrPC can also be invoked by Muslim women.

Parsi Marriage and Divorce Act, 1936

- Section 39: Allows the court to order interim alimony.

- Section 40: Enables the court to order permanent alimony to either spouse, to be paid periodically or as a lump sum, upon the passing of a divorce decree.

Who Can Claim Maintenance?

The eligibility to claim maintenance varies slightly across different laws, but generally includes:

- Wife (including divorced wife): The most common claimant. Under most laws, a wife can claim maintenance from her husband if she is unable to maintain herself. This includes wives seeking judicial separation, divorce, or those already divorced. A divorced wife loses her right to maintenance if she remarries or lives in adultery (under some personal laws).

- Dependent Children: Minor children (legitimate or illegitimate) are entitled to maintenance from their parents. Under Section 125 CrPC, even a major child who is unable to maintain themselves due to physical or mental abnormality or injury, or a married daughter who is unable to maintain herself, can claim maintenance.

- Dependent Parents: Under Section 125 CrPC and the Hindu Adoptions and Maintenance Act, 1956, parents who are unable to maintain themselves can claim maintenance from their children.

- Husband (in certain specific cases): The Hindu Marriage Act and the Special Marriage Act are unique in allowing a husband to claim maintenance from his wife if he is unable to maintain himself and the wife has sufficient independent income. However, such cases are relatively rare in practice.

Types of Maintenance

Maintenance can be categorized into two main types based on the duration for which it is granted:

- Interim or Pendente Lite Maintenance: This type of maintenance is granted during the precnency of any matrimonial proceedings (e.g., divorce petition, judicial separation, nullity of marriage). Its purpose is to provide immediate financial relief to the dependent spouse and children so that they can meet their basic needs and cover litigation expenses during the long legal battle. Courts usually pass interim orders quickly to prevent hardship. Section 24 of the Hindu Marriage Act and Section 36 of the Special Marriage Act are examples of provisions for interim maintenance.

- Permanent Maintenance: Permanent maintenance (often referred to as permanent alimony) is awarded after the final decree of divorce, judicial separation, or nullity of marriage is passed. It can be a lump sum payment or a fixed amount paid periodically (e.g., monthly). The court considers various factors (discussed below) to determine a fair and equitable amount that allows the dependent spouse to maintain a standard of living somewhat comparable to what they enjoyed during the marriage, or to ensure their financial independence. Section 25 of the Hindu Marriage Act and Section 37 of the Special Marriage Act provide for permanent maintenance.

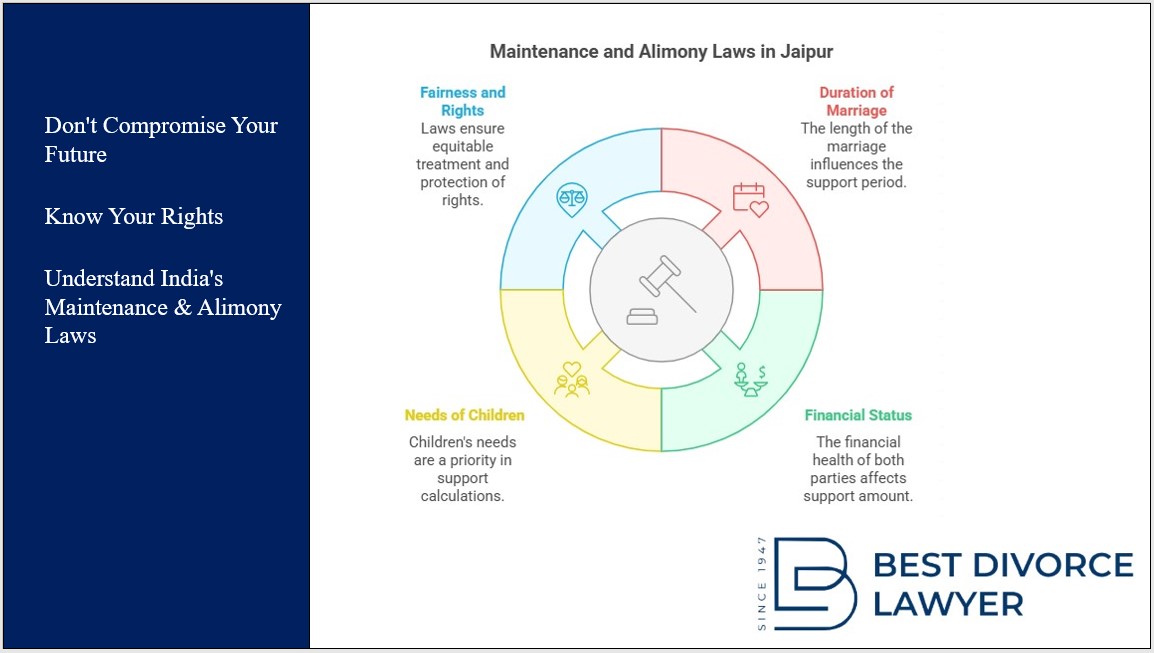

Factors Determining the Quantum of Maintenance

Determining the amount of maintenance is not based on a fixed formula. Courts consider a multitude of factors to arrive at a fair and equitable amount, prioritizing the dependent’s needs and the payer’s capacity. Key factors include:

- Financial Status and Earning Capacity of Both Parties: This is perhaps the most crucial factor. The court assesses the income, assets, liabilities, and potential earning capacity of both the claimant and the respondent. It’s not just about current income but also potential to earn.

- Lifestyle of the Parties During Marriage: The court tries to ensure that the claimant can maintain a lifestyle reasonably similar to what they enjoyed during the marriage, as far as possible, given the financial realities of separation.

- Needs of the Claimant: This includes basic necessities like food, clothing, shelter, healthcare, and education (especially for children). If the claimant has specific needs (e.g., medical conditions, elderly care), these are considered.

- Age and Health of the Claimant: A younger, healthier claimant with a higher earning capacity might receive less maintenance than an older, ailing spouse with limited re-employment prospects.

- Responsibilities Towards Children or Other Dependents: If the claimant has custody of minor children or is responsible for dependent parents, this increases their financial needs and is factored into the maintenance amount.

- Conduct of the Parties: While generally not a primary factor under secular laws like CrPC, the conduct of the parties (e.g., adultery, cruelty, desertion) can influence the quantum of maintenance under some personal laws, especially if it was the primary cause of marital breakdown. However, the welfare of the child is paramount and their maintenance is rarely affected by parental conduct.

- Duration of the Marriage: For permanent alimony, a longer marriage might lead to a longer or higher maintenance award, as the dependent spouse may have foregone career opportunities to support the family.

- Assets and Liabilities of Both Parties: Beyond income, the court looks at immovable and movable assets, investments, debts, and other financial obligations.

- Remarriage of the Claimant: The right to maintenance usually ceases if the claimant (typically the wife) remarries.

- Inflation and Cost of Living: Courts may consider the changing economic conditions and cost of living when determining or modifying maintenance amounts.

The Process of Claiming Maintenance

The process of claiming maintenance generally follows a structured legal path in Family Courts.

- Filing the Petition: The claimant (e.g., wife, child, parent) files a petition for maintenance in the appropriate Family Court under the relevant personal law or Section 125 CrPC. The petition must clearly state the grounds for claiming maintenance, the respondent’s income and assets (to the best of the claimant’s knowledge), and the amount of maintenance sought.

- Affidavit of Assets and Liabilities: Following landmark judgments by the Supreme Court (e.g., Rajnesh v. Neha, 2021), both parties are now mandated to file detailed affidavits disclosing their complete assets, liabilities, income, and expenditure. This aims to ensure transparency and prevent concealment of financial information, streamlining the process of determining maintenance.

- Court Proceedings and Evidence: Once the petition is filed, the court issues summons to the respondent. Both parties then present their arguments, cross-examine witnesses, and submit documentary evidence (e.g., salary slips, bank statements, property documents, tax returns) to support their claims regarding income, expenses, and needs.

- Interim Orders: Given the often urgent nature of maintenance claims, the court can pass interim orders for maintenance (pendente lite) at an early stage of the proceedings, based on prima facie evidence presented in the affidavits. This ensures that the dependent party receives immediate financial relief.

- Final Order: After considering all evidence, arguments, and the affidavits of assets and liabilities, the court passes a final order determining the maintenance amount, whether it’s a lump sum or periodic payment, and the duration.

- Enforcement of Maintenance Orders: If the respondent fails to comply with the maintenance order, the claimant can file an execution petition to enforce the order. Courts have various powers to enforce orders, including attaching property, issuing warrants, or even ordering imprisonment in case of willful default (especially under CrPC).

When Can Maintenance Be Denied or Modified?

Maintenance is not an absolute right and can be denied or modified under specific circumstances:

- Unchastity/Adultery of the Wife: Under most personal laws (e.g., Hindu Marriage Act, Indian Divorce Act) and Section 125 CrPC, a wife living in adultery generally loses her right to maintenance.

- Remarriage of the Wife: The right to maintenance, particularly permanent maintenance, usually ceases upon the claimant wife’s remarriage.

- Wife Having Sufficient Income: If the wife is found to have sufficient independent income to maintain herself, maintenance may be denied or reduced. However, “sufficient” is interpreted relative to her needs and the standard of living during the marriage.

- Mutual Agreement/Waiver: If the parties have entered into a valid settlement agreement (e.g., during divorce by mutual consent) where the wife waives her right to future maintenance, it may be denied, provided the agreement was not under duress.

- Change in Circumstances: Maintenance orders are not static. If there is a substantial change in circumstances of either party (e.g., significant increase in the claimant’s income, significant decrease in the respondent’s income due to no fault of their own, severe illness, or new financial burdens), the court can modify the existing maintenance order.

Key Distinctions and Considerations

Understanding these distinctions helps in choosing the appropriate legal route:

- Maintenance under CrPC vs. Personal Laws:

- CrPC (Section 125): A quick, summary remedy focused on preventing destitution. It is secular and generally grants maintenance to wives, minor children, and parents. It doesn’t require a matrimonial dispute and can be invoked even when spouses are living separately without formal divorce. The amount is usually basic to meet necessities.

- Personal Laws (e.g., HMA, SMA): These laws are invoked during matrimonial proceedings (divorce, judicial separation). They provide for both interim and permanent maintenance, which can be significantly higher as they aim to maintain a similar standard of living and consider the overall financial picture more comprehensively. They may also allow a husband to claim maintenance. Often, claims under CrPC and personal laws can run concurrently, but courts typically adjust final orders to avoid duplication.

- Tax Implications of Maintenance: In India, as per current tax laws, periodic maintenance received by the claimant is generally taxable as “Income from Other Sources” in the hands of the recipient. The payer cannot claim it as a deduction from their taxable income. Lump sum alimony, however, is generally not taxable for the recipient. It’s advisable to consult a tax advisor for specific guidance.

- Lump Sum vs. Monthly Payments:

- Lump Sum: A one-time payment. Offers finality and avoids ongoing financial ties. Can be challenging for the payer to arrange a large sum, but provides immediate financial stability to the recipient.

- Monthly Payments: Regular, periodic payments. Offers continuous support. Can be modified if circumstances change. However, it maintains a financial link between the ex-spouses. The choice depends on mutual agreement, financial capacity, and judicial discretion.

Role of a Maintenance Lawyer

Navigating the complexities of maintenance laws requires expert legal assistance. A seasoned maintenance lawyer can:

- Assess Eligibility: Determine whether you are eligible to claim or liable to pay maintenance under which specific law.

- Quantum Assessment: Help in accurately assessing the likely quantum of maintenance based on your financial situation and legal precedents.

- Petition Drafting and Filing: Prepare and file a comprehensive petition, ensuring all necessary financial disclosures are correctly made.

- Court Representation: Represent you effectively in court, presenting your case, cross-examining the opposing party, and arguing for a fair outcome.

- Negotiation and Settlement: Facilitate out-of-court settlements, including structured agreements for maintenance, potentially through mediation.

- Enforcement or Modification: Assist in enforcing existing maintenance orders or in seeking their modification if there’s a change in circumstances.

FAQs

Legal professionals at Bestdivorcelawyer.in have extensive experience in all aspects of Maintenance and family law, providing invaluable guidance and representation to ensure your financial security or fair obligations.

1. What is maintenance in Indian law? Maintenance is financial support provided to a dependent spouse, minor child, or sometimes dependent parents, ensuring their dignified living after separation or divorce.

2. What is the difference between maintenance and alimony? “Maintenance” is a broader term encompassing all financial support, including interim and post-divorce. “Alimony” specifically refers to post-divorce financial support between spouses, often paid as a lump sum or periodically.

3. Which key laws govern maintenance in India? Maintenance is governed by Section 125 of the CrPC (secular) and personal laws like the Hindu Marriage Act, Hindu Adoptions and Maintenance Act, Special Marriage Act, Indian Divorce Act, and Muslim Women (Protection of Rights on Divorce) Act.

4. Who can claim maintenance? Typically, wives (including divorced), minor children, and dependent parents can claim maintenance. In some cases, a husband may also claim from his wife.

5. What factors determine the amount of maintenance? Courts consider the financial status and earning capacity of both parties, their lifestyle during marriage, the claimant’s needs, age and health of the claimant, responsibilities towards dependents, and conduct of the parties.

6. Can maintenance be denied or modified? Yes, maintenance can be denied if the wife remarries or lives in adultery, or if the claimant has sufficient income. It can also be modified if there’s a significant change in circumstances of either party.

Conclusion

Maintenance and alimony provisions in India are a crucial safety net designed to provide financial stability to individuals affected by marital breakdown. While the laws are varied, the overarching objective is to ensure that no dependent spouse, child, or parent is left in destitution. The courts meticulously weigh various factors, from financial capacity and lifestyle to the needs and conduct of the parties, to arrive at a just and equitable maintenance order.

Whether you are seeking maintenance to rebuild your life or are faced with the obligation to provide it, understanding the legal framework, the process, and your rights is paramount. Seeking timely legal counsel from a specialized family lawyer can significantly streamline the process, protect your financial interests, and help achieve a resolution that secures a dignified future for all parties involved.

For legal assistance, call +91 9461620006 or visit www.bestdivorcelawyer.in today!